Stocks Slide…Politicians Intervene

Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

May proved to be one of the most volatile months in recent memory as evidenced by the worst monthly performance for the S&P 500 index since February 2009. Even worse, the S&P experienced its worst May performance since 1962, falling 8.2%. Equities fought to regain some of the lost ground in the final week, but it was simply not enough, with the S&P rising 0.2%.

Given the heightened volatility, it should come as no surprise that individual investor sentiment is at its worst level for the year. According to the American Association of Individual Investors (AAII), 51% of individual investors are bearish on the 6 month outlook for stocks. Those same investors hit their most bullish point on April 15th, roughly one week before the stock market reached its year-to-date apex.

With the global economy showing signs of softening, politicians in the US hit the panic button, cobbling together a proposed $200bln stimulus package. The Economist questioned whether the economy really needs a 10th stimulus considering that more than $1trln has been injected into the economy in the past 2 years. Furthermore, the Organisation for Economic Co-Operation and Development (OECD) recently ratcheted up growth expectations for OECD member nations, including the US, which the OECD now expects will grow at a 3.2% pace in 2010 and 2011, from 2.5% previously.

A vast majority of the stimulus is geared towards transfer payments (unemployment insurance, welfare, etc.), which are proven to provide no lasting benefit to the economy. Even measures that are typically stimulative will be ineffective. For instance, to pay homage to National Small Business Week last week, the bill includes a small business lending program that would cost an estimated $500mln. Unfortunately, a recent survey found that the biggest problem facing small businesses was a lack of sales, not access to credit.

The request for stimulus money came despite the creation of a recent deficit reduction committee by President Obama. Even more laughable, politicians were supposed to follow a “pay-as-you-go” mandate, offsetting spending increases with budget cuts elsewhere. This most recent bill fell under the “emergency” category and will be exempted from such rules.

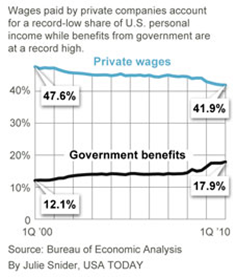

Stimulus money is entirely necessary under certain scenarios, but current spending is playing a dramatic role in reshaping the overall economy. Data from the Bureau of Economic Analysis shows that private wages are at an all time low while government benefits continue to rise, reaching 18% in the first quarter. That does not even account for income paid to government employees, another 10% of wages.

The concern, as economist David Henderson alluded to in the USA Today article, is that the allocation from private to public wages means “people are paid for being rather than for producing.”

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.

Our Team

Meet Our Award-Winning Team

Our team of fiduciary advisors creates plans as unique as you are.

Services

Full Financial Advisory Services

Holistic Financial Planning, Investment Management, and more!

About Us

We're Different on Purpose

Our refreshing "Just One Client" mindset gives us the time to serve you.