The Inflationary Trap

Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

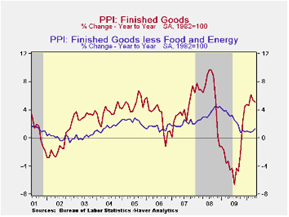

Last week’s news on the inflationary front proved to be as benign as everyone was expecting. The headline Consumer Price Index was down 0.2% month-over-month and the Producer Price Index for Finished Goods eased by 0.3%.

From the consumer standpoint, headline CPI was off modestly in the month and is now up 2.0% in the past 12 months. Core CPI, which excludes food and energy, is up only 0.9% in the past year and the Cleveland Federal Reserve’s preferred measure of consumer inflation, which excludes outlier categories, is even weaker at 0.5%.

With unemployment at elevated levels, producers are not able to pass along higher costs to consumers, reflected by the 5.1% increase in the PPI index for finished goods and the 8.4% increase in the intermediate goods index over the past 12 months.

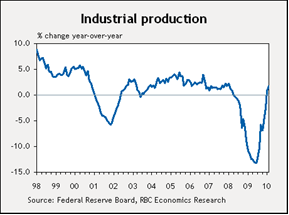

By all accounts, industrial production is well on its way to recovery, largely a function of inventory restocking since early 2009. Unless consumer demand catches up with that restocking, companies will be facing challenges in the coming quarters.

The primary problem for those companies will be higher input costs that consumers will be unwilling to stomach, placing pressure on profit margins.

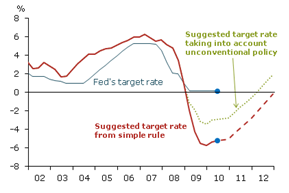

On the positive side, monetary policy remains extremely accommodative as the Fed is embracing a zero interest rate policy. According to the Federal Reserve Bank of San Francisco, interest rates should be even lower based on the interplay between rates of inflation and unemployment. Even when accounting for asset purchases by the Fed, the first Fed Funds rate hike is not anticipated by the model until 2012.

Unfortunately, should we face the double-dip recession that many are now predicting, the Fed will have little to no room to re-stimulate the economy.

In the end, inflation is showing absolutely no indication of pricing pressure on the horizon. On the other hand, companies are dealing with higher commodity prices that will likely eat away at profit margins in the next several quarters and should the economy dip back towards recessionary territory, the Fed will be limited in its ability to provide appropriate stimulation to the economy.

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.

Our Team

Meet Our Award-Winning Team

Our team of fiduciary advisors creates plans as unique as you are.

Services

Full Financial Advisory Services

Holistic Financial Planning, Investment Management, and more!

About Us

We're Different on Purpose

Our refreshing "Just One Client" mindset gives us the time to serve you.