Over the past several months, bond and equity markets have been on starkly divergent paths. Investors are growing increasingly concerned that perhaps the bond market knows something that the stock market is overlooking. In reality, the answer may be simpler than we realize.

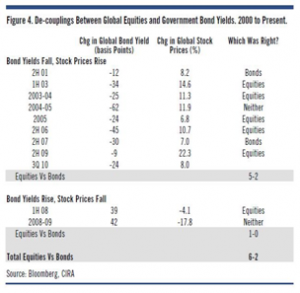

As of the middle of last week, Citi research discovered that global equities are up roughly 6% while global government bonds yields are down 25 basis points. In the U.S., the situation is even more dramatic with yields down nearly 1.5% since the peak in late April.

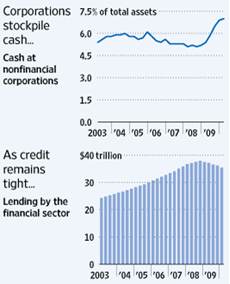

There are seemingly two explanations for the recent turn of events. The first is corporations. Corporate cash at nonfinancial companies is up 26% through March to $1.8trln, the largest such increase since at least 1952.

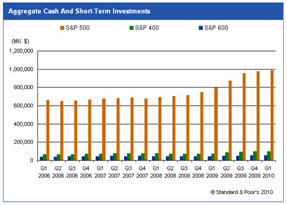

Emerging from one of the most severe recessions in the last century, companies are more than willing to hoard cash and favor a ‘wait and see’ approach before resuming expansion. Cash levels at S&P 1500 companies are well in excess of $1trln now, but, where does that extra cash wind up?

According to a recent survey from CFO.com, 74% of short-term cash is placed in bank deposits, money market funds or U.S. Treasury securities.

The second reason bond yields are falling is that individual investors continue to sell equities in favor of fixed income securities. Through July, investors took $33bln out of domestic equity funds, with much of that finding a home in the perceived safety of taxable bonds.

This is hardly the first time such an occurrence has happened. In fact, Citi found a number of occasions since 2000 where global bond yields fell as global equities rallied. In a majority of those instances, the equity markets were right. Equities continued to rally and bond yields eventually rose.

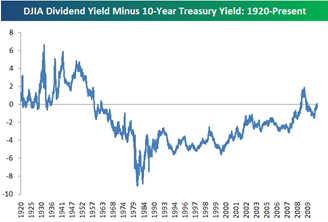

There is reason to believe that equities offer the more compelling opportunity going forward. Forgetting the impact of price appreciation, the average dividend yield on the DJIA was 2.94% as on August 13th, compared to a current yield of 2.62% on the 10-year Treasury.

The last time the DJIA had a higher yield than the 10-year Treasury was in late 2008/early 2009. It is relatively uncommon for the DJIA to exhibit a higher yield, although, in the early part of last century it was a common occurrence.

The Treasury market has been susceptible to a number of technical factors in recent months, from the recent announcement by the Federal Reserve to purchase treasuries to huge individual investor inflows. Yields could certainly fall further if the economy enters a second recession, but the likelihood of that is marginal at the moment.