Stocks Move Ahead, But Housing Stalls

Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

The resurgence in risk appetite continued apace this past week, allowing the S&P 500 index and the Dow Jones Industrial Average to return to positive territory on the year. By the end of the week, the S&P was up 2.4% and the DJIA finished up 2.3%.

Yields on US Treasury bonds ended moderately tighter on the week despite the strong performance in risk assets. At the beginning of the year, numerous prognosticators were calling for a surge in Treasury yields, but to the contrary, yields fell from 3.8% at the start of the year to 3.2% this past Friday. The explanation for this move may be simpler than we all realize.

Based on data from the Federal Reserve’s Flow of Funds report, US households are severely underinvested in Treasury and Municipal securities. With more than 50% of household assets tied up in equities and real estate, the recession of 2008/09 seems to have left a mark on many individuals, especially those in the baby boomer generation who are inching ever closer to retirement. This is fueling a reallocation away from equities in favor of bonds and income producing securities.

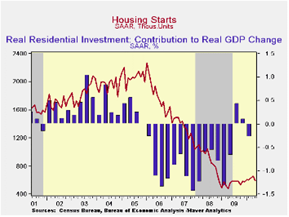

Housing: with the government gradually removing its chokehold on the housing industry, economists are growing concerned that housing is set to experience a slowdown in the second half of the year.

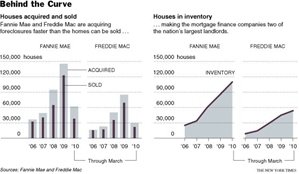

Perhaps more problematic was the news that Fannie Mae and Freddie Mac, the beleaguered US mortgage financing companies, have requested $145bln from government coffers, with one ratings agency suggesting that a $1trln financing package for those two firms is not out of the question.

According to the New York Times, foreclosures forced the two firms to take over ownership of a new home every 90 seconds during the first quarter of this year. By the end of March, the firms owned a combined 163k homes.

Long term, Fannie and Freddie will face years of losses related to sour mortgages, all at the expense of the US taxpayer.

Taxpayers are also on the hook for the current home modification program, which is looking like an unmitigated disaster at this point. The Home Affordable Modification Program (HAMP) was originally designed to provide payment relief for homeowners who were struggling under the burden of debt. Sounds simple enough, but what the government forgot to account for was all the other debts (credit cards, auto loans, student loans, etc) those individuals are carrying.

For the average person, HAMP provides $500 a month in mortgage payment relief. Even accounting for that deduction, 64% of pretax income is spent on debt payments. That is an unserviceable burden and Fitch Ratings estimates that 65% to 75% who enter the HAMP modification process will re-default within 12 months.

Recent Posts

December 12, 2024

Why One Client Fired Their Accountant—and What It Means for You

November 26, 2024

2025 Investment Outlook

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.

Our Team

Meet Our Award-Winning Team

Our team of fiduciary advisors creates plans as unique as you are.

Services

Full Financial Advisory Services

Holistic Financial Planning, Investment Management, and more!

About Us

We're Different on Purpose

Our refreshing "Just One Client" mindset gives us the time to serve you.