The Incredibly Resilient American Consumer

Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

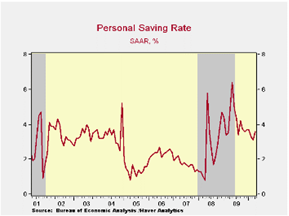

One of the most disheartening aspects of the past several years was the abysmal state of consumer finances heading into the recession. In the first quarter of 2008, the personal savings rate was a meager 0.8% of disposable income and household liabilities as a share of disposable income reached an astounding 130%. Levels that severe suggested that even the mildest recession would spiral out of control given the “quick to disappear” nature of consumer credit.

Surprisingly, consumers shook off the cob webs and made an exceptional comeback over the past 12 months. But, the story has yet to truly change; consumers are tenuously overextended and unlikely to provide the necessary boost to economic growth in the coming quarters without serious improvement in wage or credit growth.

Somewhat problematic for consumers is the realization that the economic growth of the past several quarters came at the expense of the personal savings rate, falling from a recent peak of 6.4% to 3.6% in April. In order to continue spending at the current pace, individuals need higher wage growth or easier access to credit, neither of which seems likely in the present economic climate.

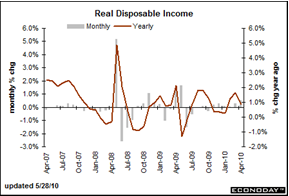

The other issue which has yet to be resolved is wage growth. In the past 12 months, disposable income is up 2.5%, after rising only 1.0% in all of 2009.

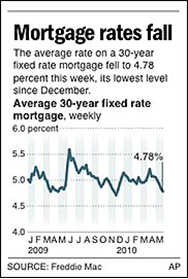

Even with the problems facing the consumer, there are several factors working in their favor. The first is lower mortgage rates. For those individuals with the ability to refinance or purchase a home at today’s historically low interest rates, the monthly savings can be sizeable. In recent weeks, the number of homeowners opting to refinance, including a fair number of Glassman Wealth Services clients hit a seven month high and as long as the situation in Europe remains unresolved, interest rates will stay low.

Second, retail gas prices are weakening. The tentative situation in Europe is pushing crude oil prices lower, to the benefit of automobile owners. Prices, while elevated, are still significantly lower than the peak endured in 2008.

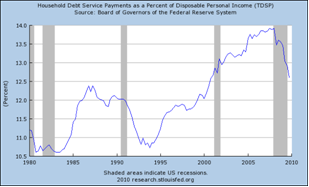

Encouragingly for consumer finances, household debt service payments as a percent of disposable personal income is on the decline. The ratio remains above the long-term average, but is returning to a more appropriate level and indicates that the consumer balance sheet is slowly being realigned.

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.

Our Team

Meet Our Award-Winning Team

Our team of fiduciary advisors creates plans as unique as you are.

Services

Full Financial Advisory Services

Holistic Financial Planning, Investment Management, and more!

About Us

We're Different on Purpose

Our refreshing "Just One Client" mindset gives us the time to serve you.